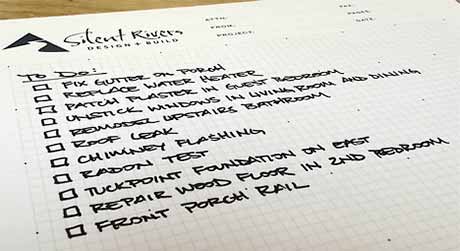

If you own an older home you are no doubt familiar with the never ending to-do list. That list is mostly comprised of various things that need to be repaired or repainted. Sometimes, however, we want to make a major change or improvement to our older home: rebuild a porch, remodel the kitchen, create a master suite.

The smaller items such as painting and minor repairs can often be handled on an ongoing basis by handy homeowners or small contractors. On the other hand, when the list contains big items or a lot of substantial repair projects and costs start to increase, many people feel overwhelmed. Where should I go for advice? How do I know whom to trust? What is the right approach? How do I fund the project? How do I make sure I keep the character of the house intact?

The key to a successful historic rehabilitation project is addressing these questions in a balanced and nuanced way. Most people who choose to live in historic homes do so because they appreciate the character and craft. They often feel a sense of connection to (or at least appreciation of) the home as a meaningful place. Perhaps they even feel a sense of responsibility as caretaker of the home for future generations.

Elements of your Home’s Historic Character

That is where we start from as we approach project planning, design, and construction. The first step is to determine what about the house defines its historic character. In most cases, we look first at the following things:

Context

What do you see from the street and how does the house relate to the homes around it? What is the home’s architectural style? When was the home built and what social forces influenced its appearance?

Exterior Architecture

Architectural elements such as porches, railings, shutters, corbels, trim, and brackets. Windows and DoorsWindows and doors are often a character-defining element on a historic house. Changing the type, size, configuration, or location of the windows and doors reduces its historic integrity.

Interior Layout

The relationship between spaces on the interior of the home is key to understanding its history. Most important are the spaces around the front entry, stair (if there is a stair), and unique rooms such as a hearth room, library, center hallway, dining room, living, room, etc.

Interior Architectural Details

Examples include wood details, wainscoting, fireplaces, trim, built-ins, historic fixtures, and stained glass.

Rehabilitation of a historic home can involve changes and updates as long as they are sensitive to maintaining the character defining elements. Often this involves updating a kitchen or bathroom or reversing an ill-considered prior remodel.

Historic Tax Credits Offset Rehabilitation Costs

If a home is located within a designated historic district or its historic significance can be documented, sensitive rehabilitation work may qualify for state historic tax credits of up to 25% of the construction cost. This can add up to a substantial return and tip a project from inconceivable to viable.

Here is a simplified example of a substantial historic rehabilitation project:

Total project cost: $100,000 (paid to contractor)

Tax Credit Eligible Expenses: $80,000 (some costs may not qualify)

Historic Tax Credits: $20,000 (25% of the Eligible Expenses)

This state income tax credit is refundable. In our example above, the homeowners will end up with a state income tax of $20,000, or 25% of the eligible project costs. The next year when taxes are filed, if their total state income tax liability is $8,000 the credit can be applied to that bill and they will receive a check back from the Department of Revenue for $12,000 (the difference between what they owe and the tax credit).

The historic tax credit process is relatively complex and can be intimidating to people who have not navigated through it before. It is strongly recommended that you involve qualified professionals to advise and assist as you explore this option. In particular, it is worthwhile to include:

Tax Advisor

The tax advisor should be familiar with historic tax credits and your personal financial situation in order to best take advantage of the program.

Design Professional

The application involves writing a thorough description of the proposed work and drawings to illustrate the project scope. A design professional who knows the applicable standards is essential.

Contractor

Your contractor should be experienced working in historic homes, preferably having worked on multiple historic tax credit projects. Work that doesn’t conform to the standards or differs from the application can jeopardize the tax credits.

The multi-stage application has three main parts: Part 1 establishes eligibility of the building, Part 2 describes the proposed scope of work, and Part 3 proves that the completed project complies with the proposed scope.

Good Stewardship of Old Homes

Good Stewardship of Old Homes

In the end, a sensitive rehabilitation project (whether historic tax credits are used or not) can add substantial value to an older home. Old-home owners are stewards of the past. There are always avenues for modernizing function, updating aesthetics, and increasing efficiency within the framework of respect for original design and craft.

Learn more about Silent Rivers’ special expertise in the area of Historic Preservation. Conscientious craftsmanship is part of every Silent Rivers historic rehabilitation project.